3 Entry Setups That Actually Work (Backtested & Battle-Tested)

3 Entry Setups That Actually Work (Backtested & Battle-Tested)

If you’ve been trading for a while, you’ve probably seen enough “perfect setups” to last a lifetime — most of them either untested or purely theoretical. We’ve filtered the fluff and narrowed it down to three setups we’ve personally backtested, forward-tested, and traded on SPY (aka the people’s ticker).

1. The Gap Fill Reversal

Setup: Look for SPY to gap up or down at the open — especially if the gap takes price outside a recent range or key level. The idea is simple: if there’s no follow-through volume, price tends to retrace and “fill” the gap.

- Entry: Wait for price to show weakness (e.g., a rejection candle or bearish engulfing) near the top/bottom of the gap.

- Confirmation: Use 5m RSI or volume divergence.

- Risk: Tight stop just above the high/low of the move.

- Profit Target: Gap fill zone or previous day’s close.

Why it works: Gaps often get filled when there’s no catalyst or institutional support. This works well in choppy markets or when news-driven overnight moves fade quickly.

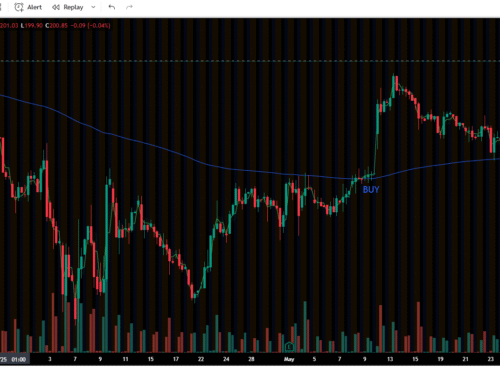

2. The VWAP Bounce

Setup: After the open, SPY pulls back to VWAP (Volume Weighted Average Price), holds it, and shows signs of strength.

- Entry: Long entry on the first green candle reclaiming VWAP after a pullback.

- Confirmation: Volume increase and/or RSI cross above 50 on the 1m or 5m.

- Risk: Stop just under VWAP or structure low.

- Profit Target: Recent high or R:R of 2:1 minimum.

Why it works: VWAP is a major intraday magnet and often respected by institutional traders. When SPY bounces cleanly off VWAP, it often signals a controlled trend continuation.

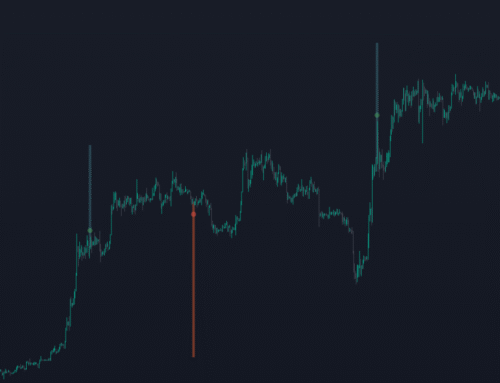

3. Trendline Break + Retest

Setup: SPY trends lower with a clear descending trendline. It breaks out with volume, then pulls back to retest the broken line as support.

- Entry: Enter long on the bounce off the retest with a bullish candle confirmation.

- Confirmation: MACD crossover or higher low on RSI.

- Risk: Stop just below the retest level.

- Profit Target: Next resistance or measured move from the breakout.

Why it works: This setup captures the breakout and the smart-money retest — ideal for traders who want confirmation instead of chasing highs.

Final Thoughts

You don’t need 30 setups. You need three that you trust, that you’ve seen in action, and that you can execute with discipline. These three have stood the test of time — on SPY, in real trades, and across multiple market conditions.

Want to see these in action? Join our Discord, where we call them out live and share real-time chart examples. We’re not here to promise Lambos. We’re here to trade smart — together.

Whether you’re just getting started or leveling up your game, Woof Streets is where traders learn, grow, and hunt — together.

We’re a Discord trading community built on trust, transparency, and real results.

We’re a fast-growing community of traders, analysts, and market junkies who know that the best setups don’t bark… they growl. Whether you’re here to learn or to ride the waves with a loyal crew, you’ve found your pack.