5 LEAP Candidates for Long-Term Growth

“Price is what you pay, value is what you get.” – Warren Buffett

As many of you know, I’ve been running what I call the Baby Roth Challenge at our Discord Server . This account was set up under my name but for my 30-month-old son, starting with a balance of $23,000. Over the past several weeks, I’ve been steadily collecting premiums, and now I’m looking ahead to adding some LEAPS (long-term equity anticipation securities) to the mix.

The idea here is simple: in a Roth IRA, gains are tax-free if held until retirement, so I want to use this account to capture asymmetric upside opportunities while still running a disciplined premium-selling strategy. Some stocks are too expensive to “wheel,” so LEAPS become the logical alternative.

Here are my five candidates for LEAPS:

- Palantir (PLTR)

- SoFi (SOFI)

- Oracle (ORCL)

- Meta (META)

- Oklo (OKLO)

Palantir (PLTR)

Palantir has been the workhorse of this portfolio. As an AI-driven company with sticky government contracts and a rapidly scaling commercial segment, the growth story is clear.

The concern with buying LEAPS here is that much of the near-term growth narrative feels priced in already. Palantir can grind higher, but it may not deliver the same explosive upside as it did in the early stages. Still, it remains a safer bet for those who want long-term AI exposure without chasing pure speculation.

Verdict: A strong core holding, though maybe limited upside relative to risk.

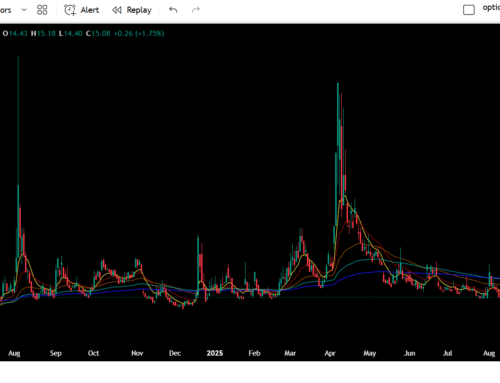

SoFi (SOFI)

SoFi is my moonshot candidate. Retail traders love it, fundamentals are improving quarter over quarter, and if interest rates ease, this name could absolutely take off. The LEAPS are relatively cheap compared to the others, making the risk/reward profile very attractive.

Of course, volatility cuts both ways. A consumer credit downturn or broader financial stress could easily knock SoFi down 50% or more. But that’s the game — high risk, high reward.

Verdict: Best “swing for the fences” pick.

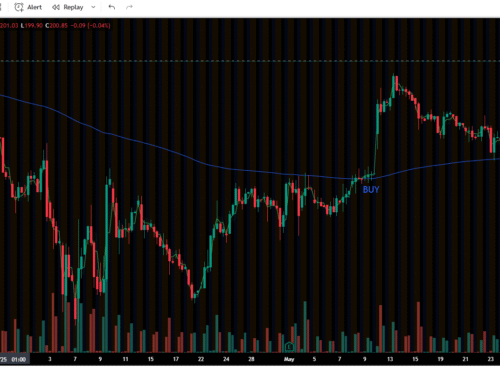

Oracle (ORCL)

Oracle has long been thought of as a boring tech giant, but that narrative is starting to change. Their most recent earnings blew expectations out of the water, driven by surging demand in cloud infrastructure and AI-related workloads. The stock jumped more than 27% after hours — hardly the move of a “boring” company.

For a Roth, Oracle actually fits well. You’re not going to double overnight, but a 30–50% upside over a couple years is realistic. The LEAPS here are pricier but align perfectly with a premium-selling strategy. It’s a balance of safety and steady growth.

Verdict: The balanced, steady choice.

Meta (META)

Meta continues to prove itself as a cash-generating machine. Advertising demand is strong, Reels monetization is accelerating, and they’re funding ambitious AI and metaverse projects without crippling the core business.

A LEAP on Meta is expensive but extremely solid. This could serve as a “blue chip anchor” within a Roth — less about moonshots, more about compounding strong returns in a tax-free wrapper.

Verdict: Reliable tech giant with a strong long-term runway.

Oklo (OKLO)

Now for the wild card — but in my view, also the dark horse powerhouse. Oklo is at the forefront of next-generation nuclear technology, an area that could be transformative for global energy demand. Nuclear power is gaining fresh momentum as governments look for clean, scalable baseload energy to support AI data centers, electrification, and industrial growth.

Yes, the stock has already made a big run, and liquidity in the options chain can be thin. But this isn’t a typical “lotto ticket” — it’s a true growth disruptor. If the story plays out, Oklo could move from speculative to mainstream in a hurry. A LEAP here carries higher risk due to spreads and volatility, but the upside potential is enormous if nuclear re-rates in the coming decade.

Verdict: A beast in the making. High conviction if you believe in nuclear’s future.

My Ranking for the Baby Roth Challenge

- Oracle (ORCL) — Balanced, safe, steady growth

- SoFi (SOFI) — Moonshot with big upside potential

- Meta (META) — Reliable big tech anchor

- Palantir (PLTR) — Solid, but growth may already be priced in

- Oklo (OKLO) — High-risk, high-reward nuclear disruptor

Final Thoughts

The beauty of the Roth IRA is that it rewards long-term thinking. LEAPS allow me to capture multi-year upside without tying up the entire account in shares. My goal isn’t to swing for home runs only — it’s to create a blend of safety, growth, and calculated risks that could compound into something life-changing by the time my son is old enough to use it.

Whenever I’m ready to pull the trigger on one of these LEAPS, I’ll update the challenge. Stay tuned — this journey is just getting started.

Whether you’re just getting started or leveling up your game, Woof Streets is where traders learn, grow, and hunt — together.

We’re a Discord trading community built on trust, transparency, and real results.

We’re a fast-growing community of traders, analysts, and market junkies who know that the best setups don’t bark… they growl. Whether you’re here to learn or to ride the waves with a loyal crew, you’ve found your pack.