What is an Iron Condor

An Iron Condor is an options income strategy that uses two credit spreads on opposite sides of the market to profit when the underlying stays in a range. The trade limits risk by buying protection further out of the money on both sides while collecting premium from the sold options.

How it works

- Sell one out of the money call and buy one further out of the money call to form a call credit spread

- Sell one out of the money put and buy one further out of the money put to form a put credit spread

- The two spreads together create a big neutral zone where the trade can make its maximum profit which is the net premium collected

- The maximum loss is the spread width minus the net premium collected

Example trade

Underlying price one hundred dollars expiration in about thirty days

| Leg | Side | Strike | Premium |

|---|---|---|---|

| Call sell | Sell | 110 | 0.90 |

| Call buy | Buy | 115 | 0.30 |

| Put sell | Sell | 90 | 0.95 |

| Put buy | Buy | 85 | 0.25 |

Call spread credit equals 0.90 minus 0.30 which is 0.60

Put spread credit equals 0.95 minus 0.25 which is 0.70

Total credit equals 0.60 plus 0.70 which is 1.30 per share or one hundred thirty dollars per standard contract

Each spread width is five points because 115 minus 110 equals five and 90 minus 85 equals five

Maximum loss equals spread width minus total credit which is 5 minus 1.30 equals 3.70 per share or three hundred seventy dollars per contract

Maximum profit equals the total credit collected which is one hundred thirty dollars per contract

Break even points are:

- Upper break even equals short call strike plus total credit which is 110 plus 1.30 equals 111.30

- Lower break even equals short put strike minus total credit which is 90 minus 1.30 equals 88.70

Why traders use it

- Collects premium when you expect the market to stay in a range

- Defined risk plain math for position sizing

- High probability of small steady gains when used responsibly

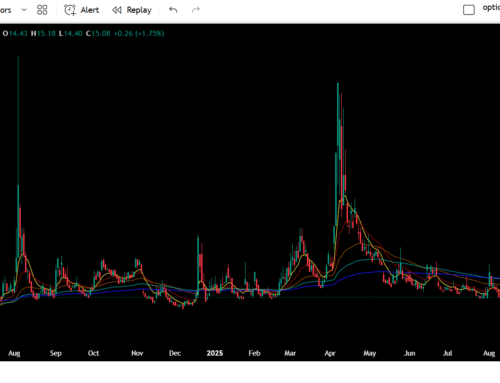

When to use and when to avoid

- Consider using when implied volatility is elevated and you can collect attractive premium

- Avoid during major events that can cause big directional moves unless you plan to adjust quickly

- Best for traders who want income and are comfortable managing defined risk positions

Trade entry and sizing

- Decide how much you are willing to lose per trade for example one percent to two percent of your account

- Calculate position size using maximum loss which is spread width minus net credit times one hundred

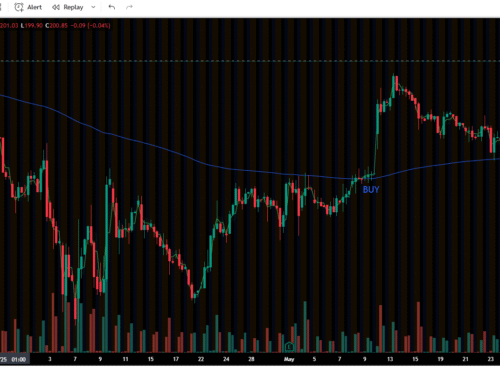

- Enter when reward parameters match your plan and market context matches your edge

Common adjustments

- Take profits early when a target percent of the credit is realized to lock gains

- Close a losing side if the underlying threatens to hit the short strike and keep the other side intact

- Roll the threatened side in time or strike to buy breathing room but be mindful of added risk

- Convert to a different neutral structure if your view changes and the market is likely to move a lot

Risks to watch

- Large directional moves can expose you to the full predefined loss if the move crosses the protection leg

- Early assignment risk on short options in American style contracts especially on short puts around dividend dates

- Broker margin rules and maintenance requirements can vary so check with your broker

- Commissions and fees can eat into the credit collected so account for them in your sizing

Greeks at a glance

- Delta is small near the middle of the range but grows as the underlying moves toward a short strike

- Theta or time decay helps a credit position as days pass and options lose value

- Vega matters because rising implied volatility can increase the value of the wings which can widen risk

Checklist before you enter

- Know your maximum profit and your maximum loss

- Decide your exit rules for profit and loss

- Confirm margin impact with your broker

- Check for upcoming events that can cause big moves

Whether you’re just getting started or leveling up your game, Woof Streets is where traders learn, grow, and hunt — together.

We’re a Discord trading community built on trust, transparency, and real results.

We’re a fast-growing community of traders, analysts, and market junkies who know that the best setups don’t bark… they growl. Whether you’re here to learn or to ride the waves with a loyal crew, you’ve found your pack.