Applied Digital (APLD) Stock DD: NVIDIA AI Data Center Play with CSP Opportunity

Applied Digital (APLD) Stock DD: NVIDIA AI Data Center Play with CSP Opportunity

I’m looking into my next candidate for CSP in my Baby Roth Challenge.

Look, I wish I could wheel NVDA and META, but since capital is limited, I’m taking a chance on a cheaper stock with potential.

Full DD on APLD (Applied Digital) — NVDA / AI data center angle

What they do

Applied Digital builds, owns, and operates large-scale data center campuses focused on high-performance computing (HPC) and AI workloads. Historically tied to crypto-mining infrastructure, APLD has pivoted toward hosting GPU-heavy AI customers and “neocloud” providers that lease compute capacity and GPUs.

Why this matters for an NVDA angle: AI workloads require massive GPU deployments (mostly NVIDIA GPUs today). Companies like CoreWeave and other AI cloud providers lease space, power, and racks from data-center operators. APLD wins when these customers deploy NVIDIA GPU fleets inside APLD facilities — it’s an indirect, lower-capital way to get exposure to the AI compute buildout without paying NVDA multiples.

Key public proof points: APLD announced major long-term leases and AI-focused campus builds, including a multi-hundred-megawatt lease with CoreWeave and multi-GW campus projects aimed at AI demand. :contentReference[oaicite:0]{index=0}

Why I’m interested

- Secular tailwinds: AI training and inference needs continue to grow rapidly, creating durable demand for GPU-hosting capacity.

- Operational leverage: Once campuses are built and leased, data-center operators can generate long-term contracted revenue over 10–15+ year terms.

- Capital efficiency vs NVDA: For a small account, selling CSPs on APLD is a cheaper way to play AI infrastructure upside than buying NVDA shares or options directly.

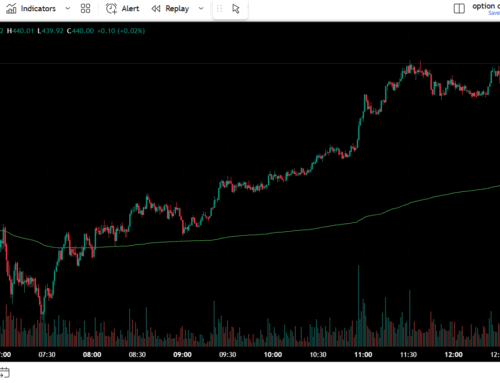

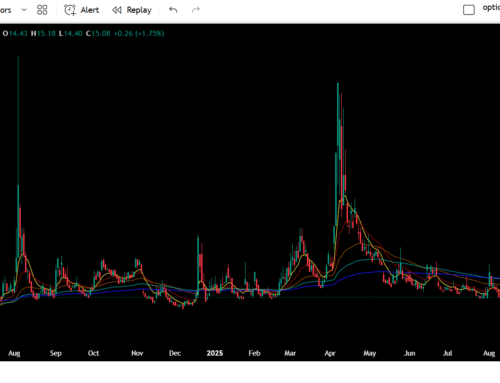

- Premiums and volatility: APLD has historically had elevated option premiums, which helps CSP sellers collect meaningful income while waiting for assignment.

Risks

- Execution risk: Building campuses, deploying power, and onboarding large GPU customers is capital and time intensive. Delays or lower-than-expected leasing slow revenue growth.

- Capital structure: APLD has posted net losses and sizable capex. Watch debt levels, cash runway, and any dilutive financings. Recent quarters included large non-cash items impacting net loss. :contentReference[oaicite:1]{index=1}

- Sentiment tethered to crypto: The company’s history in crypto infrastructure means sentiment still flips with crypto cycles — that can drive big volatility even if AI fundamentals are improving.

- Customer concentration: Large long-term leases are great when they pan out, but dependence on a few big tenants (CoreWeave, others) is a single-point risk.

Financial & operational snapshot

- APLD revenue growth has been strong year-over-year as cloud services and GPU cluster deployments ramp. Recent quarters showed expanding revenue but headline net losses due to non-cash debt revaluations and heavy capex. :contentReference[oaicite:2]{index=2}

- Notable deals: APLD signed multi-year, multi-billion-dollar lease deals (e.g., large CoreWeave leases) that should drive long-term contracted revenue if fully executed. :contentReference[oaicite:3]{index=3}

- Valuation and volatility: APLD has experienced a major re-rating in 2025 as AI narratives strengthened, moving from single-digit prices earlier in the year toward much higher levels as market excitement grew. That re-rating increases option premium but raises the risk of pullbacks. :contentReference[oaicite:4]{index=4}

Key catalysts to watch

- Execution & build milestones on Polaris Forge and other campus projects (ground breaks, power delivery, phased capacity coming online). :contentReference[oaicite:5]{index=5}

- Official capacity deployments from tenants (CoreWeave, other neoclouds) and announcements of NVIDIA systems being deployed at APLD sites. :contentReference[oaicite:6]{index=6}

- Quarterly revenue ramp and guidance showing contracted backlog converting to revenue.

- Any capital raises or debt paydown activity — watch dilution risk and cash runway. :contentReference[oaicite:7]{index=7}

How I’d play it (CSP / Baby Roth style)

Because NVDA is capital-heavy, I prefer to sell cash-secured puts on APLD instead of buying NVDA outright. My plan:

- Sell puts ~15–25% below current price to target a cheap assignment price.

- If assigned, start selling covered calls (the wheel) to monetize shares while holding for AI upside.

- Keep position size small — this is a speculative, execution-dependent play, not a core holding.

- Monitor tenant announcements, campus build milestones, and any financing moves that change dilution risk.

Bottom line

APLD is a leveraged, execution-sensitive play on the AI data-center buildout that benefits from NVIDIA GPU demand. For traders with limited capital, CSPs offer a capital-efficient way to gain exposure while collecting premium. But don’t underestimate the risks — heavy capex, potential dilution, and execution delays can zero out the narrative quickly. If you believe in sustained GPU demand and APLD’s ability to execute deals like the CoreWeave lease, this is a reasonable speculative CSP candidate. If not, stay in NVDA or larger, more proven infrastructure names.

Sources / further reading: Applied Digital press releases and financials, CoreWeave lease announcement, recent earnings release. :contentReference[oaicite:8]{index=8}

Whether you’re just getting started or leveling up your game, Woof Streets is where traders learn, grow, and hunt — together.

We’re a Discord trading community built on trust, transparency, and real results.

We’re a fast-growing community of traders, analysts, and market junkies who know that the best setups don’t bark… they growl. Whether you’re here to learn or to ride the waves with a loyal crew, you’ve found your pack.