Corgi’s Winter Camp is Here!

Corgi’s Winter Camp is Here!

Learn to master mindset, spot setups, time trades, and manage risk with real examples and live guidance from Corgi. 1-on-1 mentorship built in too! Read Corgi’s Bio >>

**Camp is now closed.

Meet your Instructor, Corgi

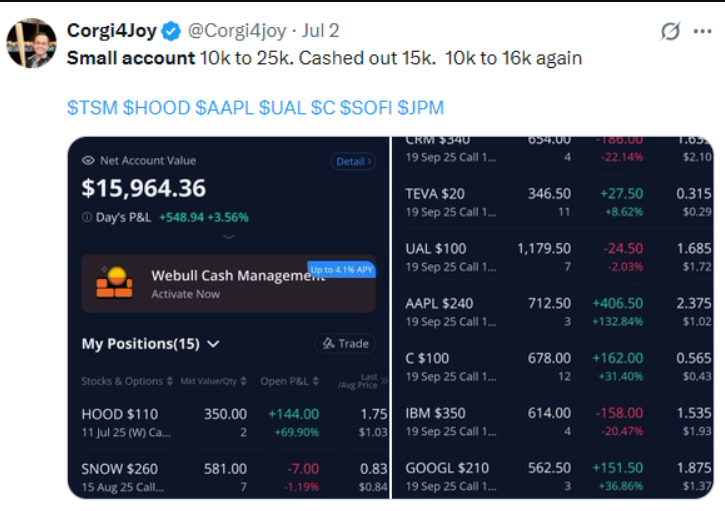

Thy Vu, also known as Corgi4joy, is the team’s top analyst and lead instructor, specializing in long-term swing options and short-term momentum trades in both options and small caps.

With a background in the Army, multiple advanced degrees, and years of experience in finance and healthcare, Corgi brings a disciplined and analytical approach to the market. He started trading small caps in 2022, scoring major wins like HKD ($20 to $2000) and CXAI (800%), before shifting his focus to options for more flexible, strategic plays.

Today, Corgi focuses on mid- to large-cap swing trades, using 4H and daily charts for precision. Known for his daily SPY levels, watchlists, and straightforward “Keep It Simple Sexy” style, he helps traders find clean setups without overcomplication.

Outside the market, Corgi balances a full-time career, a hobby farm, and family life — proving that trading success is possible even with a busy schedule.

Corgi’s Camp Course Outline

Week 1 — Options Trading for Beginners

Part 1: Getting Started

- Choose a broker and get approved to trade options (Robinhood, Webull, Schwab, IBKR, etc.).

- Account approval level: Level 2 (long calls & puts, straddles, strangles).

- Pros & cons of options trading.

- Risk management fundamentals (bid/ask dynamics; expect to “start out red”).

- How options can amplify returns with defined risk.

- Time horizons: short-term vs. long-term approaches.

- Q&A

Part 2: Ready to Play

- Selecting tickers to trade.

- Choosing expiration dates.

- Calls vs. puts: when and why.

- Predicting/choosing strike prices.

- Q&A

Week 2 — Charting for Options & Small Caps

What We’ll Chart

- Momentum stocks and daily setups with strong risk–reward.

- How to find candidates and build a watchlist.

Charting with Webull

- Timeframes: 1-min, 15-min, 4-hour, Daily.

- Indicators: MACD, RSI, EMA/MA.

Charting with TradingView

- Replicating the Webull setup.

- SuperTrend and complementary trend tools.

Support & Resistance on SPY (Daily)

- Pre-market high/low.

- 1-hour supply zones.

- 20-day moving average.

Practice & Flows

- Self-practice assignments for Weeks 3–4.

- Q&A

Week 3 — Charting SPY Daily & Looking at Flows

Charting SPY Daily Levels

- Mark overnight high/low and pre-market range.

- Map daily support & resistance zones for intraday setups.

- Use 20-day MA and 200 EMA for trend context.

- Identify key session levels: previous day high/low/close, VWAP, opening range.

- Translate SPY levels into option strike selection and risk parameters.

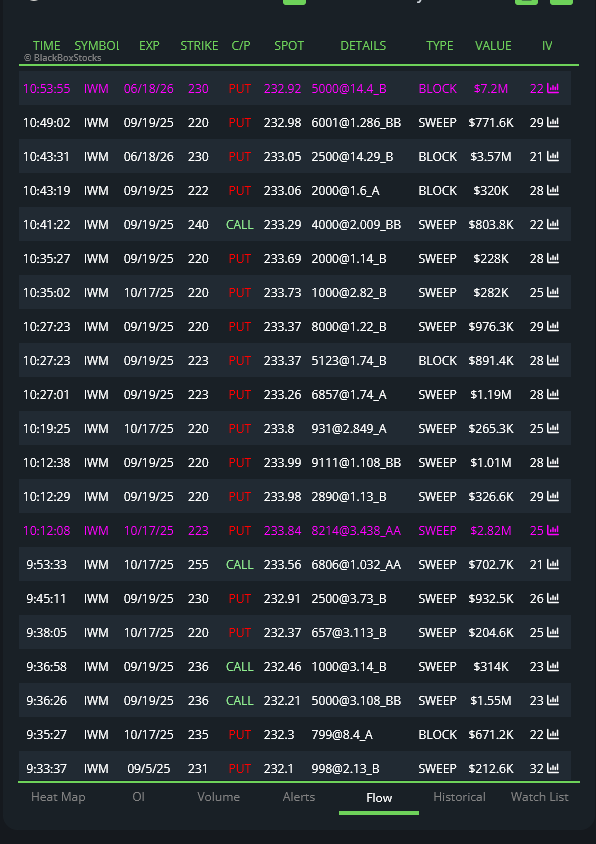

Options Flow with Unusual Whales

- Read flow types: sweeps vs. blocks, size, expiry, moneyness.

- Black Box Stocks / Unusual Whales

- Filter signals: clusters, repeat buyers, premium concentration.

- Track call/put imbalance and align with chart bias.

- Differentiate hedges vs. directional bets.

- Build a simple flow → level → trade checklist.

Practice & Application

- Live demo: building the SPY pre-market plan from scratch.

- Pair flow data with chart levels to choose strikes, entries, and exits.

- Case studies: flow confirming vs. misleading chart levels.

Q&A

- Review of member charts and flow interpretations.

- Troubleshooting entries, strike selection, and risk management.

Week 4 — Psychology: Trade Like a Robot

- Establish rules, stick to them, and implement risk controls.

- Self-control and discipline; consistency over intensity.

- Common cognitive traps: regret bias & emotional decision-making.

- Managing risk and handling losses constructively.

- Maintaining long-term sustainability.

- Meditation, education, and awareness routines.

- Q&A

Week 5 — Short-Term vs. Long-Term Approaches

What Do You Want to Be?

- Clarify your style: short-term trader or long-term investor.

- Scaling out: maximize profit, minimize loss.

Long-Term (Lower Risk, More Stable Returns)

- Long calls/puts dated 3–6 months out.

- Rolling options effectively.

- LEAPS (Long-Term Equity Anticipation Securities).

Short-Term (Higher Risk, Higher Potential Reward)

- Earnings plays.

- Trading around major news & catalysts.

- “Black Friday” style discount shopping after big moves.

- Daily 0DTE SPY/QQQ tactics.

- Q&A

Week 6 — Trading in the Zone & The Greeks

Pre-Trade Setup

- Selecting underlyings (e.g., AMZN, SOFI, BA, GOOGL, MSFT, etc.).

- Bid/ask mechanics and why positions often start red.

Strategy Toolbox (Examples)

- Single-leg options.

- Covered options.

- Straddles & strangles.

- Calendars.

- …and more.

Key Option Concepts

- Implied Volatility (IV) and Open Interest.

- Greeks overview: Delta, Gamma, Theta.

- Q&A

Week 7 & 8 — Q&A & Chart Reviews

- Open Q&A and follow-ups

- Comprehensive Chart Reviews

- Walk-through of key workflows from prior weeks

- Reinforce rules, risk management, and execution checklists

What our clients says about Corgi4joy

”

@Corgi4joy is truly one of the best and most genuine traders I’ve come across. I’m so grateful our paths crossed. He doesn’t just share his trades—he takes the time to break down his reasoning, strategies, and gameplay in a way that’s easy to understand. I’ve asked him questions, some of which were probably basic or even silly, but he never judged me. Instead, he always responded with thoughtful, detailed answers.

It’s clear that Corgi genuinely loves trading and has a passion for teaching others. I started trading options a few months ago as a way to build financial freedom for my family. Even though my family thinks I’m wasting my time, I keep grinding in silence because I know why I’m doing this. Having a supportive community makes all the difference, and Corgi has been a huge part of that.

There was a moment when I felt like giving up, and I reached out to him. Instead of brushing me off, he gave me words of encouragement that helped me push forward. What makes him stand out is that he hasn’t forgotten the struggles of being a beginner. Unlike many traders who only share their wins, he remembers what it’s like to be at the start of the journey.

For that, I’ll always be grateful.🙏🙏🙏🙏

Andrew K. — 8/23/25, 5:58 AM

”

I can honestly say I wouldn’t be the trader I am today without the guidance of my trusted friend @Corgi4joy. From the very beginning, he has been more than just a stock trader, he’s been a mentor, motivator, and someone I could always count on. Whether it was late night messages breaking down strategies or simply being there when I needed to vent about a tough day in the market, he never failed to give me his time and energy.

What sets him apart is not only his deep knowledge of trading, but also his willingness to invest in me as a person. He explained concepts thoroughly, walked me through the “why” behind every move, and always made sure I understood rather than just followed. His encouragement has consistently pushed me to grow, both as a trader and as an individual.

He has a rare gift: the ability to bring out the best in people. Through his live trading sessions, I’ve found confidence, discipline, and success in trading that I never imagined possible. I’m grateful not just for what he’s taught me about the market, but for the support, patience, and genuine care he’s shown every step of the way. 💯 📈

Avery — 8/22/25, 4:38 PM

Disclaimer

Corgi is not a licensed financial advisor, broker, or psychologist. This is strictly based on Corgi’s experience and his results is not typical. Also any discussions on trading psychology, such as “trading like a robot,” are based on personal experience and opinion, not professional psychological counseling. All content is for educational and informational purposes only and should not be taken as financial or mental health advice. Trading carries risk, and each individual is responsible for their own decisions.

Join Woof Streets to follow Corgi’s trades!

Join Woof Streets to follow Corgi’s trades!

Step inside the Woof Street Discord, where Corgi shares his daily SPY levels, swing setups, and watchlists. Whether you’re learning the ropes or refining your strategy, you’ll get real insights and a supportive trading community to help you grow.