If you buy calls, you’re paying someone for the right to buy their shares later. The person on the other end — the call seller — already owns the shares and is happy to rent them out for a few weeks in exchange for premium. That’s a covered call in a nutshell.

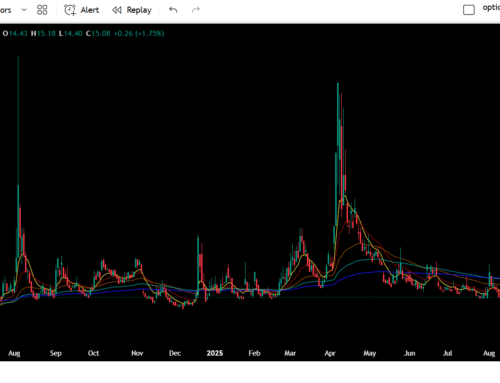

Quick SOFI example

SOFI trading at 28.68. You own 500 shares (that’s 5 contracts worth).

- Look at the 11/28 expiry.

- Sell the 30 call for about 2.34 (≈ $234 per contract).

- Sell 5 contracts → collect roughly $1,170 premium up front.

How it plays out

- If SOFI stays under 30 by 11/28 — you keep your shares and the $1,170 premium.

- If SOFI closes above 30 — your shares get called away at $30. You still keep the $1,170 premium plus the price gain from 28.68 → 30.

The downside is you cap upside above $30 until expiration. If SOFI explodes to $35, you miss that extra run because you already agreed to sell at $30. Still, covered calls are a simple way to generate steady income on shares you plan to hold.

Buyers vs Sellers — plain talk

When you buy calls, you pay premium hoping it moons. Who do you pay? The seller — the one collecting rent on their shares. So if you’re often buying calls, remember there’s always someone on the other side collecting that premium and willing to sell their stock at the strike. Selling covered calls is just flipping roles: you become the rent collector instead of the lottery ticket buyer.

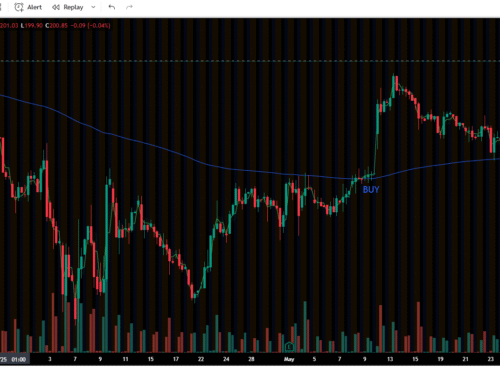

Options tips (quick)

- Pick a strike based on how much upside you’re willing to give up (30 vs 32 vs 35).

- Closer strike = more premium, less room to run. Higher strike = less premium, more upside.

- Covered calls work best if you’re happy to hold or sell at your target price.

Whether you’re just getting started or leveling up your game, Woof Streets is where traders learn, grow, and hunt — together.

We’re a Discord trading community built on trust, transparency, and real results.

We’re a fast-growing community of traders, analysts, and market junkies who know that the best setups don’t bark… they growl. Whether you’re here to learn or to ride the waves with a loyal crew, you’ve found your pack.