Day Trading Options vs Swing Trading: Which Is Right for You?

Day Trading Options vs Swing Trading: Which Is Right for You?

Day Trading Options vs Swing Trading: Which Is Right for You?

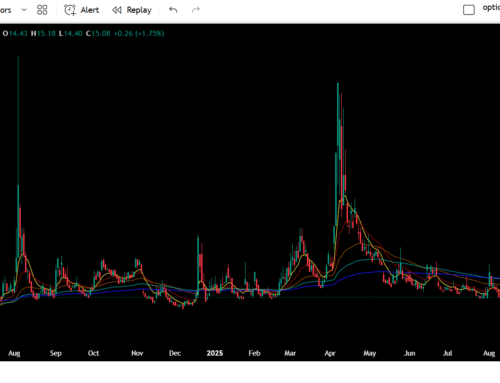

Woof Streets • Options Trading Community

If you are exploring options trading, one of the first big choices is whether to focus on day trading options or swing trading options. Both styles can work, but they ask for different skills, different time commitment, and a different mindset. This guide breaks down the core differences so you can pick the path that fits your goals.

What Is Day Trading Options

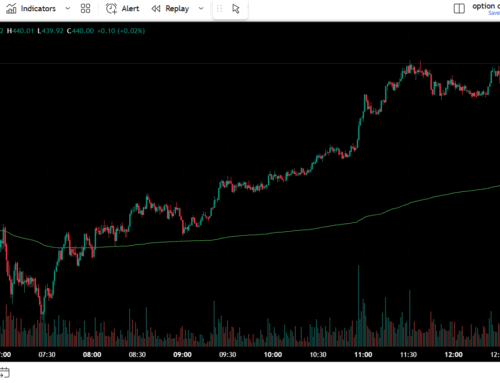

Day trading options means opening and closing positions within the same trading day. Traders look for short term price moves in stocks and indexes and act with speed and discipline.

- Pros: Quick results, no overnight risk, many intraday opportunities.

- Cons: High stress, strict risk rules needed, requires full attention during market hours.

Day traders lean on technical analysis, price action, and momentum. If you enjoy fast decisions and can stay focused, this style may suit you.

What Is Swing Trading Options

Swing trading options holds positions for several days or weeks. The aim is to capture larger moves that play out over time instead of minute by minute noise.

- Pros: Less stress, easier to balance with a busy schedule, potential to catch bigger trend moves.

- Cons: Overnight risk, slower feedback loop, patience required.

Swing traders blend chart reading with broader market context and news flow. It is a strong fit if you cannot sit at a screen all day but still want meaningful exposure.

How To Choose Your Style

The best choice depends on your time, temperament, and targets.

- Pick day trading if you want fast pace action, have time to watch the tape, and can follow a strict plan without hesitation.

- Pick swing trading if you value a calmer pace, want to hold through multi day swings, and can manage risk through gaps and news.

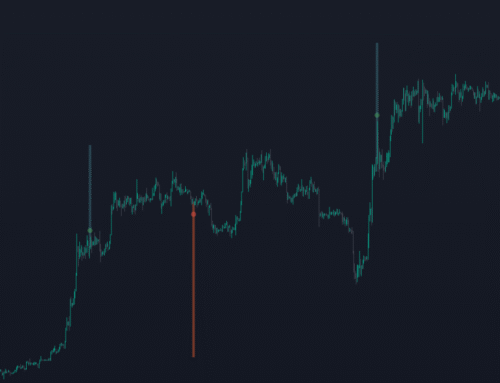

Many traders use both styles. For example, you might day trade index options for cash flow and hold a small swing options position on a strong trend. Test what works, track results, and stay consistent.

Risk Management Comes First

Whether you day trade or swing trade, risk management is the edge. Define max loss per trade, size positions with intent, and respect your stops. Volatility, time decay, and liquidity all impact option pricing. Treat each trade like a business decision.

Join the Woof Streets Options Trading Community

If you want real support, live discussion, and trade ideas in real time, join our options trading Discord. Learn proven options trading strategies, get day trading tips, and share swing setups with a team that focuses on process and discipline.

Whether you’re just getting started or leveling up your game, Woof Streets is where traders learn, grow, and hunt — together.

We’re a Discord trading community built on trust, transparency, and real results.

We’re a fast-growing community of traders, analysts, and market junkies who know that the best setups don’t bark… they growl. Whether you’re here to learn or to ride the waves with a loyal crew, you’ve found your pack.