Introducing Nilly’s Trading Lab

Introducing Nilly’s Trading Lab

Winning strategy. Practical rules. Learn options and swing trading with data driven clarity and hands on mentorship. Read Nilly’s Bio >>

**Nilly’s Trading Lab is now full. Stay tuned for the next lab.

Meet Nilly — They call him the GOAT.

Nilly is not just another trader calling random plays. He is a strategist who blends data, discipline, and instinct. With an Executive MBA from Georgia Tech and over a decade in AI, automation, and machine learning, Nilly has spent years decoding complex systems. That same analytical edge is what he brings to the markets every single day.

He started with long term equity investing then pivoted into options two years ago. Like most traders he paid market tuition early on. Those lessons formed a clean playbook based on price action, supply and demand, golden zone imbalances, and repeatable trade rules. Today he trades options and futures and focuses on swing setups that offer asymmetric reward to risk.

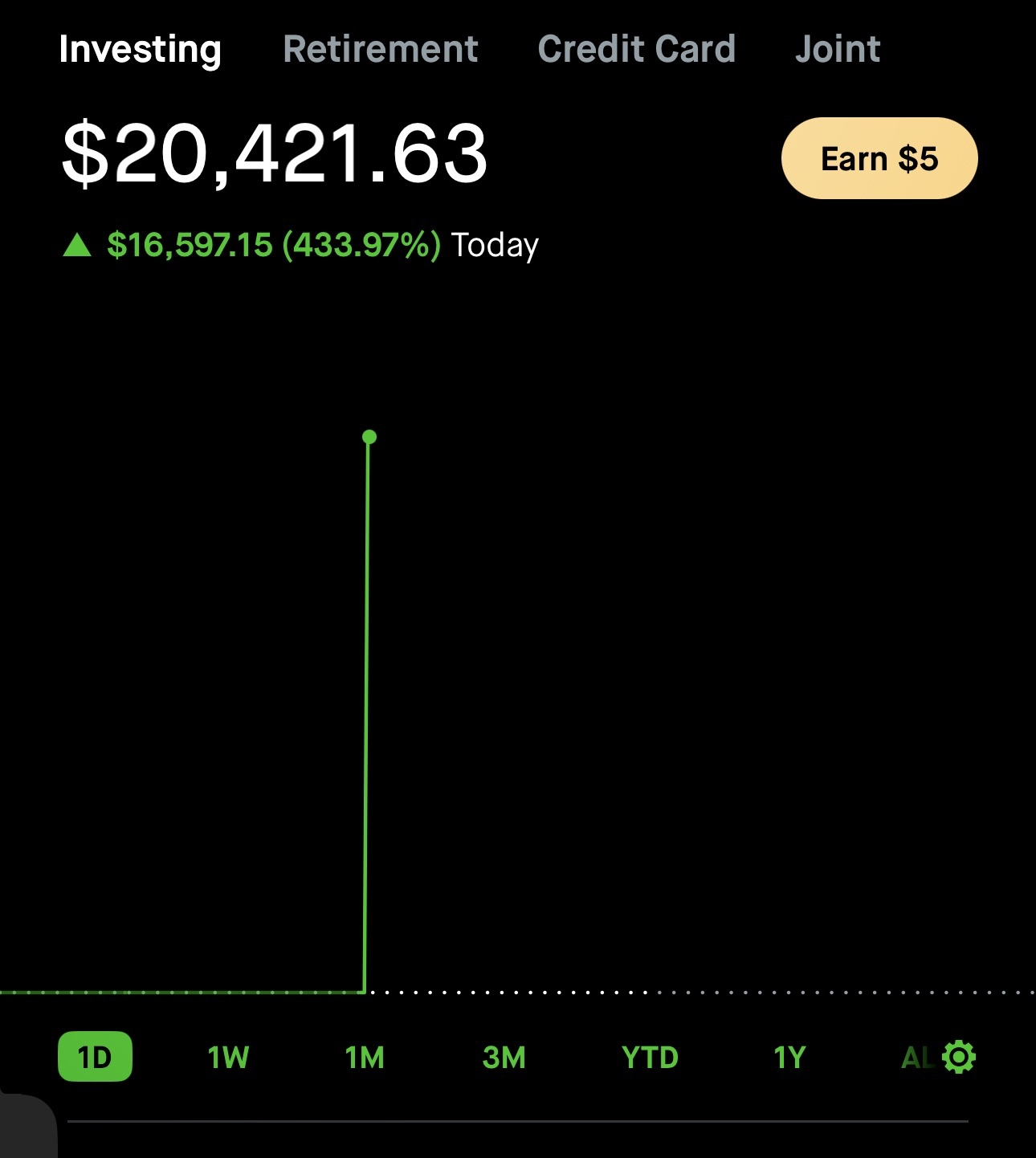

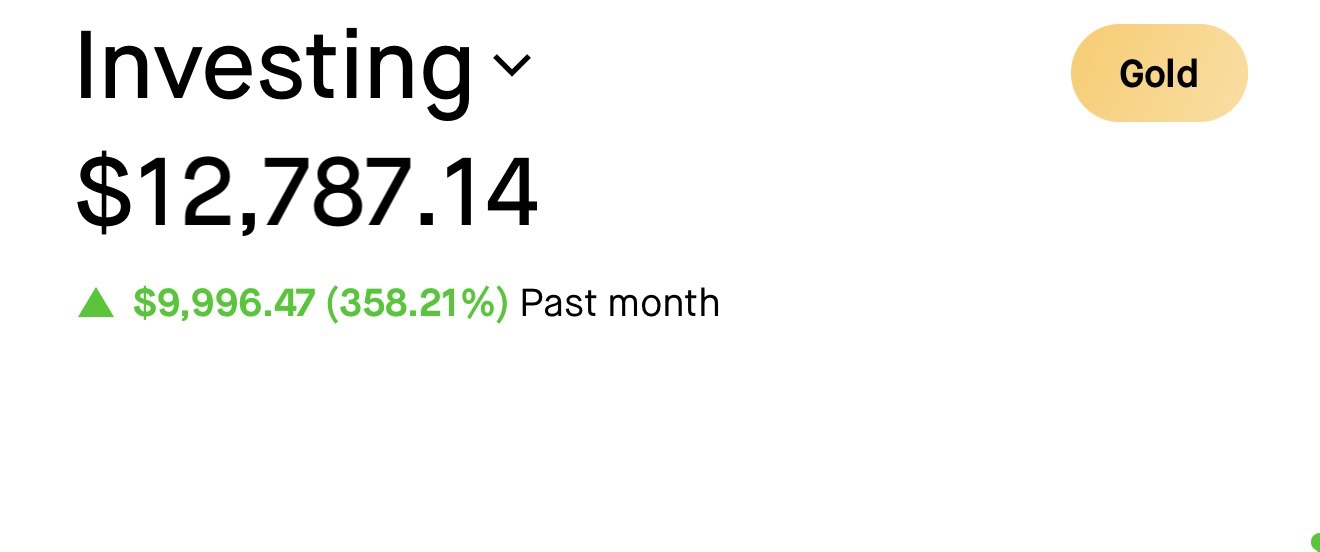

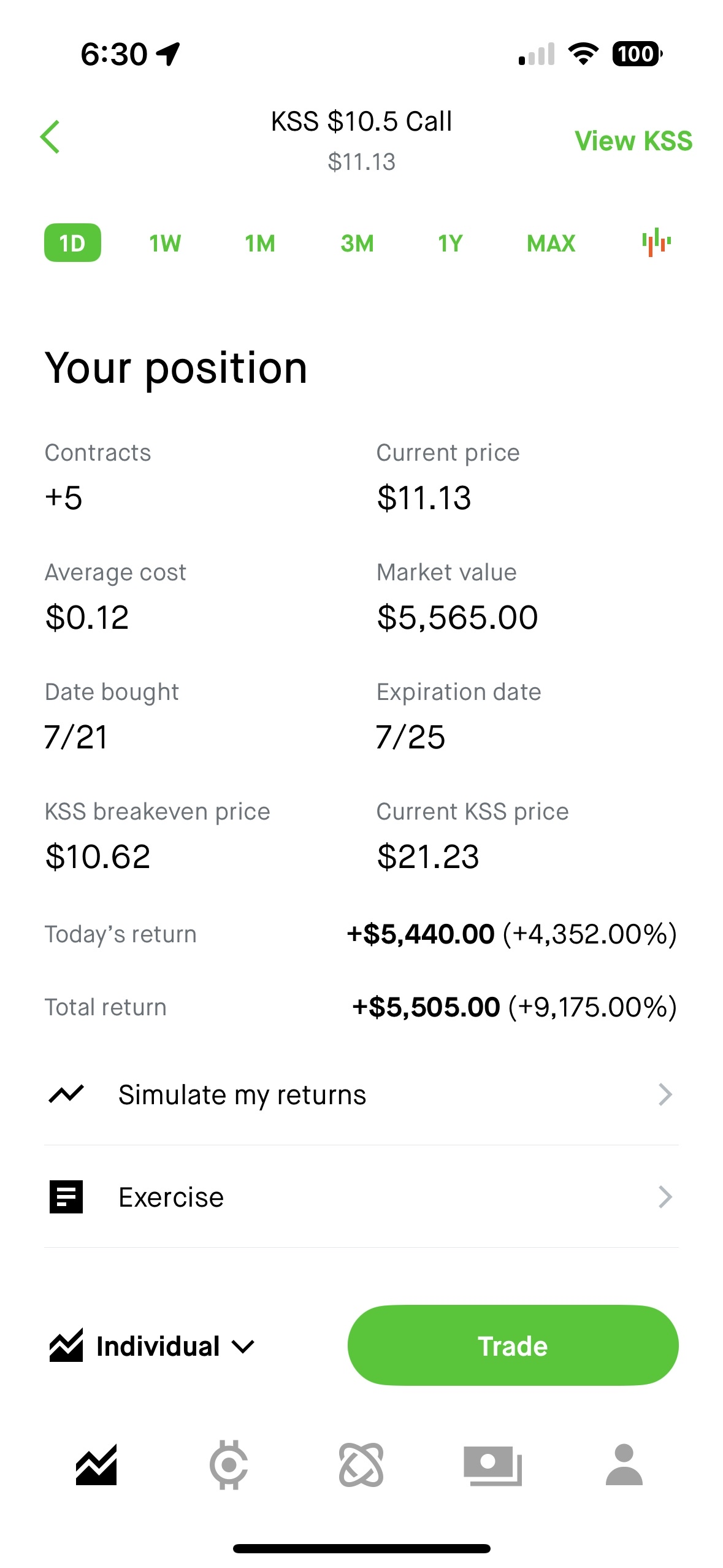

Proof in Performance

- Led a 2K challenge to 12K in just 2 months

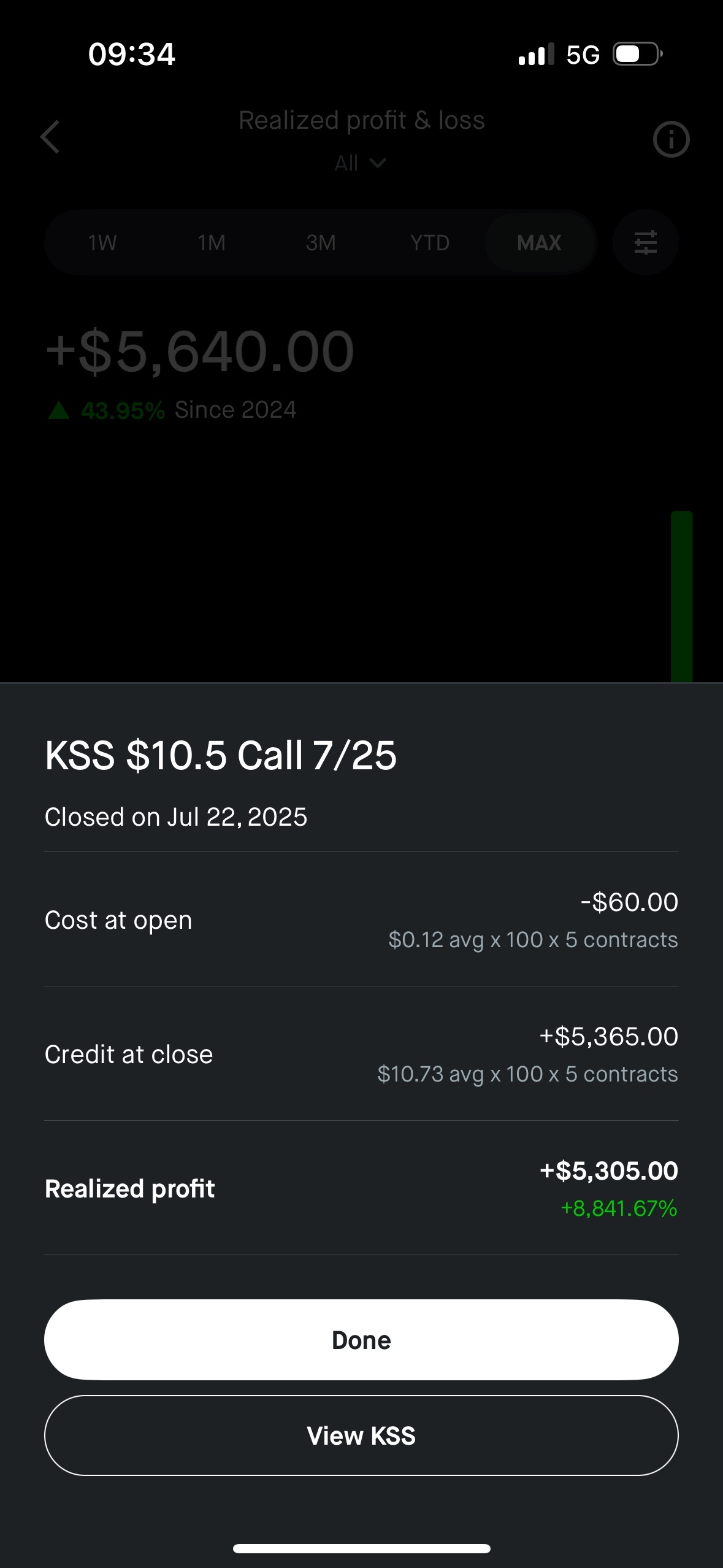

On June 3rd Woof Streets launched a guided 2K account. By the end of August the account had grown to 12K. Nilly found golden zone and imbalance setups that repeatedly worked and turned the challenge into a clear win. - Explosive documented plays

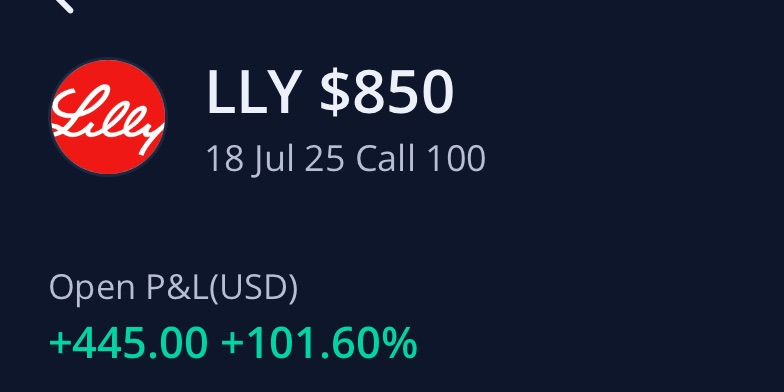

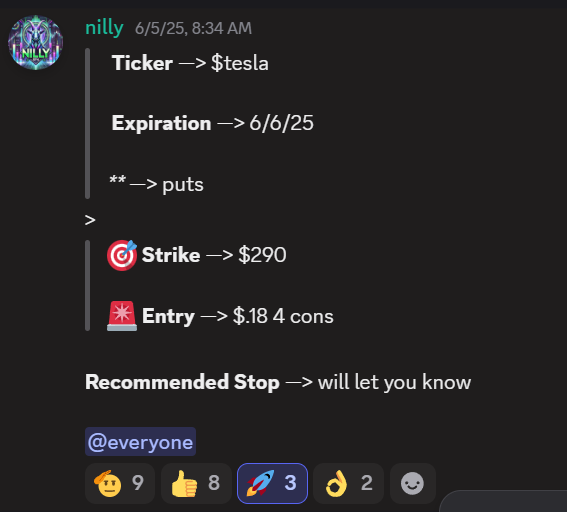

KSS 7/25 Call delivered 9000 percent plus. TSLA June Put returned 1000 percent plus and would have reached 14000 percent plus if held longer. All calls were verified and logged during the guided 2K challenge.

What Nilly Teaches

- Spotting supply and demand imbalance zones and golden entries

- Using multi timeframe structure to time entries

- Managing position size and exits so a single loss never wrecks the plan

- Translating data driven insight into actionable trades

Why Traders Join Nilly

Traders come for the edge and stay for the process. If you want a mentor who teaches how to find setups that can explode while keeping risk in check, this is the training to consider.

June 3 to end of August 2K to 12K via a documented guided account. Verified trades. Repeatable rules. Live mentorship.

Ready to learn? Nillys Trading Lab is built to give you the structure and feedback loop you need to move from inconsistent guesses to repeatable results.

Week 1 — Foundations: Options, Supply and Demand, Channels

Objectives

- Understand what options are and how they differ from owning stock

- Spot supply and demand zones that matter on charts

- Recognize price channels and basic trend structure

Core topics

- Options basics: calls versus puts, strike price, expiration, premiums

- Intro to the Greeks that matter for beginners: delta, theta, vega explained simply

- Supply and demand: how to identify imbalance zones and why they work

- Channels: ascending, descending, and sideways consolidation and how to draw them

Exercises

- Mark supply and demand zones on five different charts

- Draw channels on five trending tickers and label the structure

- Paper trade two simple options trades: one call and one put and log the decisions

Week 2 — Swing Trading Deep Dive

Objectives

- Find clean swing trade setups with repeatable entry rules

- Build a practical watchlist and trade plan you can execute each week

- Understand timeframe selection and how it affects entries and exits

Core topics

- Swing trading versus day trading: psychology and risk differences

- Tools for swing trading including Fibonacci and structure based entries

- Multi timeframe analysis to refine entry and exit points

- Finding catalysts such as earnings, news, and momentum that can move trades

Exercises

- Build a five stock swing watchlist with a short thesis for each ticker

- Mark swing highs and swing lows on daily and four hour charts for your watchlist

- Backtest one swing entry method on six months of historical data and report results

Week 3 — Floor and Ceiling: Entries Stop Losses and Reassessment

Objectives

- Master support and resistance as floors and ceilings for entries and risk

- Build rules for entering trades with confluence and cutting losses with confidence

- Practice reassessment and post trade review to speed learning

Core topics

- Support and resistance: horizontal levels and trendline based structure

- Entry techniques: breakouts, retests, and reversal patterns with examples

- Risk reward rules and setting targets using simple math and structure

- Emotional discipline: how to cut losses and extract lessons from losing trades

Exercises

- Identify floor and ceiling zones on ten charts and justify each mark

- Practice placing stop losses below support or outside structural zones for multiple setups

- Journal three paper trades including rationale entry stop and lessons learned

Week 4 — Putting It Together: Execution Review and Live Feedback

Objectives

- Combine everything into clear trade routines and a weekly workflow

- Watch live setups and get direct mentor feedback

- Build a repeatable process you can follow after the course ends

Core topics

- Trade execution checklist and weekly review template to keep you accountable

- Position sizing and rules for managing winners and losers

- Live case studies, group chart review, and how to present a trade idea

Exercises

- Execute a small live or paper trade using the full checklist and submit the journal

- Complete a weekly review and receive mentor feedback on trade management

- Capstone presentation: present one setup to the group and explain your plan

What our clients says about Nilly

”

Shoutout to my guy Nilly — the real MVP. Hooked me up with a trade that literally sent my portfolio to the moon. I’m talking $16k in a single day. This man doesn’t miss. If Nilly says it’s a move, you better believe it’s a damn power play. Appreciate you bro — that’s legendary status right there.

VXN — 7/22/25

”

I have no words this is absolutely nuts! @nilly an absolute banger my man thank you!

ajruiz — 7/22/25

”

Been following nills’s guided just over a month.

Synderlan — 7/22/25

”

why is this shitter up, no clue but thank you @nilly

P — 7/22/25

Join Woof Streets to follow Nilly’s trades!

Join Woof Streets to follow Nilly’s trades!

Step inside the Woof Street Discord, where Nilly shares his daily SPY levels, swing setups, and watchlists. Whether you’re learning the ropes or refining your strategy, you’ll get real insights and a supportive trading community to help you grow.