📊 Options Day Trading DD (0DTE + Swing)

Options can look confusing, but the basics are straightforward. Let’s break it down in a way that actually matters for day traders.

1️⃣ What is an Options Contract?

- An options contract gives you the right to buy (Call) or sell (Put) 100 shares of an underlying stock (like SPY).

- Instead of paying full price for 100 shares of SPY ($657 × 100 = $65,700), you pay a much smaller premium to control those shares.

- That premium moves fast based on price, volatility, and time to expiration.

2️⃣ Why Day Traders Use 0DTE (Zero Days to Expiration)

- 0DTE contracts expire the same day.

- They’re cheap compared to longer expirations.

- They move wildly because there’s no time left — all value is tied to immediate price movement.

- A small move in SPY = huge percentage gains (or losses).

⚠️ Reminder: leverage cuts both ways. 0DTE can go to +1000% or -100% in minutes.

3️⃣ SPY Example (Today at $657)

Imagine you grab SPY 659 Calls expiring today when SPY is trading $657.

- Premium (contract price) = $0.20 ($20 per contract)

- Each contract controls 100 shares, so you’re risking $20.

Now SPY rips to $659.15. Your calls go in the money:

- Premium explodes to $2.00 ($200 per contract)

- That’s a 900% gain (from $20 → $200).

But then SPY quickly drops to the 655s:

- Your calls lose value fast — maybe back down to $0.05 ($5 per contract).

- You gave back nearly the whole gain in minutes.

That’s the 0DTE game: you can bag massive returns, but you must take profits and manage risk, because premiums can evaporate just as quickly.

4️⃣ Swing Trading vs 0DTE

0DTE:

- Ultra short term, scalp plays.

- High risk, high reward.

- Perfect for quick reactions to intraday levels, news, or momentum.

Swing Options (1–4 weeks out):

- More stable, less “all or nothing.”

- Premium doesn’t decay instantly, but moves slower.

- Better if you want to ride a trend (e.g., SPY rejection at resistance → hold puts for a few days).

5️⃣ How to Think About Premium Movement

- The closer your strike price is to SPY’s price, the more sensitive premium is.

- The less time left, the more explosive the move (both up and down).

- In the money (ITM) = option has intrinsic value, moves more dollar-for-dollar.

- Out of the money (OTM) = cheaper lotto-style plays, move in % terms the fastest.

6️⃣ Key Takeaways for Our Discord

- Most of our base likes alerts and simple plays. That’s why SPY 0DTE is so attractive — you see the results instantly.

- Swing options are for slower movers who want less stress.

- Either way, risk management is everything. One good hit can be a 900% banger. One bad slip can wipe your contract to zero.

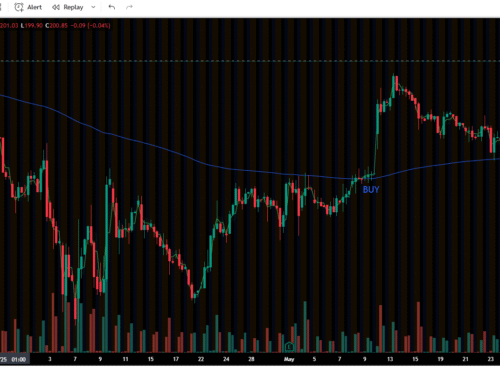

🔥 Example Recap

- Bought SPY 659C for $20 → SPY to 659.15 → contracts $200 → 900% win.

- SPY drops to 655 → contracts crash back near worthless.

- Moral: take profits, don’t get greedy.

Whether you’re just getting started or leveling up your game, Woof Streets is where traders learn, grow, and hunt — together.

We’re a Discord trading community built on trust, transparency, and real results.

We’re a fast-growing community of traders, analysts, and market junkies who know that the best setups don’t bark… they growl. Whether you’re here to learn or to ride the waves with a loyal crew, you’ve found your pack.