Poor Man’s Covered Call (PMCC) Strategy

Poor Man’s Covered Call (PMCC) Strategy

A lower cost way to generate income with options

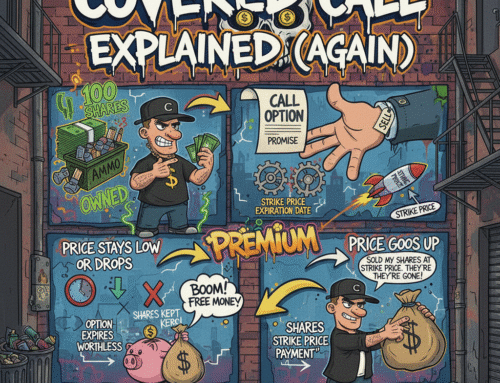

What is a PMCC

A Poor Man’s Covered Call is a covered call alternative that requires much less capital.

Instead of buying one hundred shares of stock, you buy a deep in the money call with a long expiration date.

This acts as your stock replacement. Then you sell a shorter dated call option against it to generate income.

How it works

- Buy a deep in the money call with high delta and long expiration, often six to twelve months out

- Sell a short term out of the money call, usually one to four weeks out

- The long call behaves like stock while the short call collects premium just like a covered call

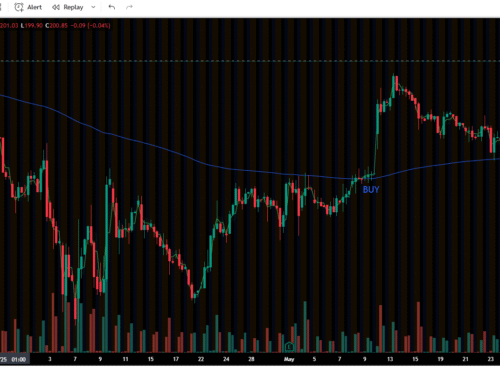

Example trade

Stock is trading at one hundred dollars

- Buy January 2026 70 call for $35

- Sell October 2025 105 call for $2.50

You spend $3500 on the long call instead of $10000 for one hundred shares.

The short call brings in $250 which lowers cost basis and generates income.

As time goes by you can repeat selling short calls to collect more premium.

Why traders like PMCC

- Much cheaper than buying one hundred shares

- Still allows consistent premium selling for income

- Defined risk compared to uncovered options

Risks and things to watch

- Decay of the long call. You need to hold a high delta LEAPS call so it behaves like stock

- Assignment risk if the short call finishes in the money

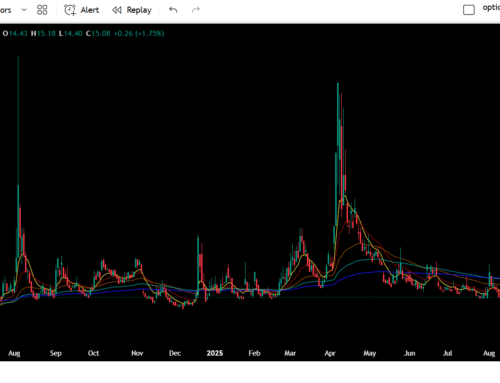

- Liquidity and spreads. Pick underlyings with active options markets

Whether you’re just getting started or leveling up your game, Woof Streets is where traders learn, grow, and hunt — together.

We’re a Discord trading community built on trust, transparency, and real results.

We’re a fast-growing community of traders, analysts, and market junkies who know that the best setups don’t bark… they growl. Whether you’re here to learn or to ride the waves with a loyal crew, you’ve found your pack.