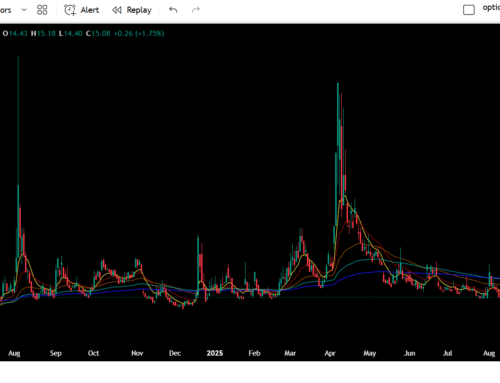

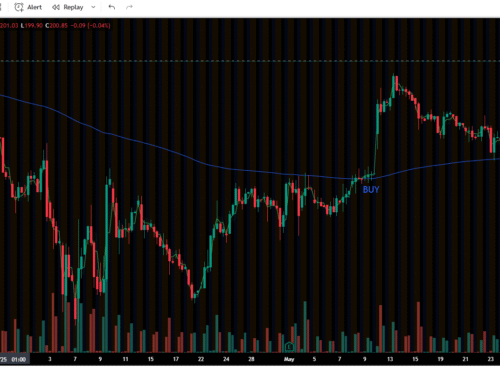

A lot of people jump into options thinking every play is a lottery ticket. Truth is, the strategy matters more than the hype. Here’s a simple breakdown:

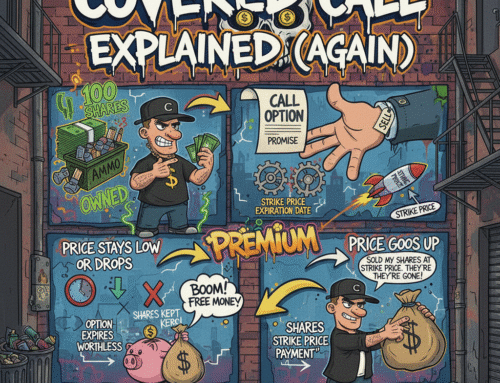

Covered Calls – Perfect if you already own shares and want to collect premium while holding. Works best in sideways or slow uptrend markets.

Cash Secured Puts – Great way to get paid while waiting to buy a stock you actually want at a lower price. If it never hits, you still keep the premium.

Spreads (Debit and Credit) – Good for limiting risk. You cap your downside but also your upside. Useful when IV is high or you want defined risk.

Iron Condors – Neutral strategy for range-bound stocks. More advanced, but a solid way to take advantage of time decay.

LEAPS – Long term calls on companies you actually believe in. Think of it like stock ownership with leverage.

Moral of the story: don’t just yolo calls or puts. You don’t need to trade ODTES or just go yolo calls or puts. Options are tools, not scratch-off tickets. Not everyone can sit and listen to our great live traders either. Match the strategy with the market conditions and your reality.

What’s your go-to strategy right now?

Whether you’re just getting started or leveling up your game, Woof Streets is where traders learn, grow, and hunt — together.

We’re a Discord trading community built on trust, transparency, and real results.

We’re a fast-growing community of traders, analysts, and market junkies who know that the best setups don’t bark… they growl. Whether you’re here to learn or to ride the waves with a loyal crew, you’ve found your pack.