The Current Market Climate: Caution Is Warranted

The Current Market Climate: Caution Is Warranted

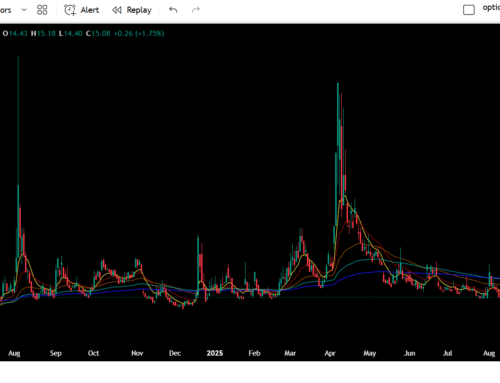

In recent months, the stock market has shown signs of strain. While valuations remain elevated and many major indices hover near all-time highs, numerous warning lights are flashing. Investors are increasingly asking: Is this just a pullback or something more serious?

Several key trends point toward heightened risk:

- Overvaluation: Asset prices, especially in tech and growth sectors, have surged well ahead of earnings growth. In particular, stocks tied to the artificial intelligence (AI) narrative are trading at multiples that many analysts describe as unsustainable.

- Diverging fundamentals: Some core indices are lagging despite the broader market rally, suggesting optimism may be decoupled from underlying business performance.

- Gigantic capital expenditures: Tech giants are pouring hundreds of billions of dollars into AI infrastructure and data centers. While investment alone does not guarantee returns, the scale of those commitments increases the stakes.

- Investor sentiment nearing extremes: Many fund managers now believe AI-related stocks are in a bubble, raising concern about a sudden sentiment reversal.

These conditions do not guarantee a crash, but they do raise the probability of a sharp correction. When a market rests on one dominant narrative, the risk increases that sentiment shifts rapidly.

Why the Market Could Be Going Down More

Here are some reasons the market may not yet be done dropping:

- Narrative risk & overhyped expectations

The “AI will change everything” story is powerful, but when companies fail to deliver on promises, sentiment can reverse quickly. Many firms carry valuations that assume exponential growth years ahead. - Interest rates & liquidity constraints

While central banks may adjust rates in the future, monetary policy remains a constraint. Higher borrowing costs make risky growth plays less appealing, and valuations get punished when funding tightens. - Infrastructural & operational bottlenecks

Even with mega investments, building AI infrastructure, powering data centers, securing talent, and turning abstract models into profitable business units is challenging. Delays or cost overruns can spook markets. - Sentiment & momentum reversal

Markets can remain “unreasonable” for long, but when they turn, the move down tends to be faster than the move up. If leading sectors start rolling over, the broader market may follow.

Is the AI Boom a Bubble?

Yes — signs strongly suggest that the current AI boom has bubble characteristics. That doesn’t mean AI itself is worthless — it means that the market’s expectations may be inflated.

- Many firms with limited revenue or profitability are commanding spectacular valuations.

- The sheer size of the investment is extraordinary, with hundreds of billions poured into AI infrastructure and R&D.

- Surveys and institutional warnings indicate concern that the bubble may already be forming.

Not all bubbles pop dramatically, and not all companies suffer equally. Heavyweights with strong fundamentals may survive and thrive, while smaller players may be wiped out or severely de-rated.

What This Means for Investors & Traders

Given the environment, here are actionable thoughts:

- Play defense: Tighten risk controls, use stop-losses, reduce exposure to ultra-high-valuation names, and focus on cash-flow positive companies.

- Don’t count just on the narrative: Focus on business fundamentals; avoid relying solely on hype.

- Scale matters: Larger firms may benefit from AI infrastructure scale; smaller firms may struggle.

- Be prepared for a correction: Analysts discuss potential drawdowns in tech and AI-heavy portions of the market.

- Diversify and hedge: Reduce concentration in high-risk areas and increase allocations to undervalued sectors or safer geographies.

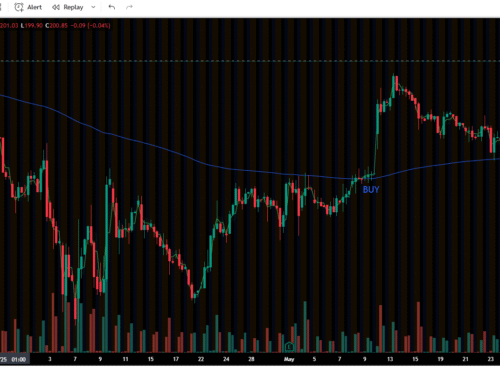

- Watch leading indicators: Chip stocks, capital spending trends, and AI infrastructure build-out may signal the next leg of the move.

Final Thoughts

The current market stands at a precarious juncture. On one hand, AI is real and holds immense long-term potential. On the other hand, valuations, investment scale, and investor enthusiasm have combined to form a structure that looks very much like a bubble.

This is not a signal to flee markets entirely but a signal to act smart, stay flexible, and be ready for volatility. When the dust settles, opportunities will emerge for those who positioned themselves defensively and remained vigilant.

Whether you’re just getting started or leveling up your game, Woof Streets is where traders learn, grow, and hunt — together.

We’re a Discord trading community built on trust, transparency, and real results.

We’re a fast-growing community of traders, analysts, and market junkies who know that the best setups don’t bark… they growl. Whether you’re here to learn or to ride the waves with a loyal crew, you’ve found your pack.